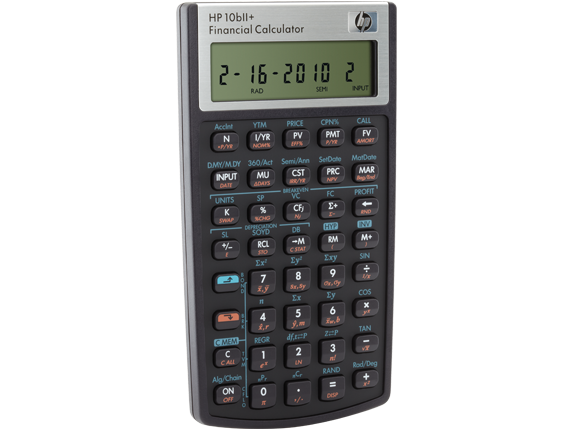

The downside is that IRR is much more conceptual than NPV. Whereas if you said the NPV on this project is $2 million, your audience may ask for a reminder of what NPV is and nod out before you get even partway through your explanation that “it means the present value of the future cash flows of this investment using our 10% corporate hurdle rate exceeds our initial investment by $2 million.” We get 4% more return on this project,’” says Knight. “If I have a project where IRR is 14% and our corporate hurdle rate is 10%, your audience thinks, ‘Oh, I get it. Know what your project is worth in today’s dollars.Ĭompanies generally use both NPV and IRR to evaluate investments, and while NPV tells you more about the return you can expect, financial analysts “often rely on IRR in presentations to nonfinancial folks.” That’s because IRR is much more intuitive and easy to understand. “There’s no point in going through the math, because it’s always done electronically,” says Knight. Luckily, you can easily calculate IRR in Excel or on a financial calculator. Instead, you’ll have to use an iterative process where you try different hurdle rates (or annual interest rates) until your NPV is equal to zero. You can’t just use the $3,900 total cash flow to figure the rate of return because it’s spread out over three years. For example, say you’re proposing a $3,000 investment that will bring in $1,300 in cash for each of the following three years. If the IRR is higher, it’s a worthwhile investment. But with IRR you calculate the actual return provided by the project’s cash flows, then compare that rate of return with your company’s hurdle rate (how much it mandates that investments return). With NPV you assume a particular discount rate for your company, then calculate the present value of the investment ( more here on NPV). That’s because the two methods are similar but use different variables. According to Knight, it’s commonly used by financial analysts in conjunction with net present value, or NPV.

The IRR is the rate at which the project breaks even. There are a variety of methods you can use to calculate ROI - net present value, payback, breakeven - and internal rate of return, or IRR.įor help in deciphering this I talked with Joe Knight, author of HBR TOOLS: Return on Investment and cofounder and owner of the Business Literacy Institute, to learn more about how IRR works and when to use it. But how can you be sure that it’s a worthwhile investment? Any time you propose a capital expenditure, you can be sure senior leaders will want to know what the return on investment (ROI) is. You’ve got a great idea for a new product that will increase revenue or a new system that will cut the company’s costs.

0 kommentar(er)

0 kommentar(er)